With much of the country getting their first taste of wintry weather this past Thanksgiving weekend, many have likely begun thinking about that next great golf getaway. Earlier in my career, I spent a couple of years away from golf, overseeing marketing and research for a cruise line. One of the more fascinating dynamics of that industry is the consolidated booking window for the majority of cruise vacations.

Known as wave month, this was the time that most cruise brands placed the significant majority of their media weight, to build brand awareness and push target consumers down the purchase funnel. The golf travel sector is not as beholden to the wave month phenomenon. In fact, as golf destination marketers have become more aware of the broader competitive context in which they compete, the savviest among them, with year-long destination appeal, have recognized that there are seasonal as well as customer segment-specific points of differentiation that can fuel the most effective marketing messaging.

Our firm has had the pleasure to work with a number of well-known golf destinations on a variety of research initiatives. Among the more insightful have been those that take a dual approach that looks at both acceptors and rejectors of specific offerings. In other words, we’ll look at those who have selected a client property or region and compare and contrast them attitudinally and demographically to those who instead chose to visit a direct competitor.

This type of research, ideally conducted through both surveys and qualitative immersion, reveals distinct points of strength and weakness that can be used to effectively create a differentiated positioning for the client property.

While this work is largely proprietary and ideally hones in on specific amenity offerings, there are a number of overarching lessons that we’ve uncovered of late that have broader application for the golf travel market. We continue to see an environment that remains healthy overall, but fiercely competitive. In our omnibus work, we’ve found that a number of attitudinal agreement statements have all shown meaningful increases over the last eight to ten years of our research. One of the more compelling trends has been a significant +18% increase over the past ten years in those golf travelers who strongly perceive golf to be their “personal oasis from the day-to-day chaos.”

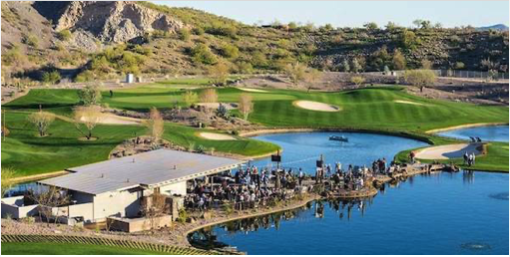

This has implications for resort courses and is in lockstep with other work that we have done, where golf course aesthetics, weather conditions and climate and overall course quality rank at the top of the list among the most significant decision drivers. This continues to suggest golf’s differentiating power to evoke relaxation and escape — a perfectly leverageable selling point for golf resorts and destinations. Relative to a decade ago, golfers want to do something big, something active and something that represents comfort and indulgent rewards for a frenetic and complex day-to-day life.

We’re also seeing a strong niche in the mini-vacation market. Be it the buddy trip, or the long weekend, golfers are getting their R&R and golf in more frequent, bite-sized portions. This also translates to family vacations, where access to golf facilities that meet the above criteria, can often tip the scales for those trying to cram as many experiences as possible into a singular condensed vacation.

Perhaps one of the more illustrative examples of this phenomenon, came to light in some focus groups that we conducted with married couples, recently, for a multi-resort property. Here, we saw first hand that while golf-specific amenities may not be the primary destination driver for family travel, those properties that can make it easy and guilt-free for the golfer in a family of diverse interests to squeeze in a round or other golf-related experience (simulators, ranges, short courses) amidst other broader family-related activities, commands greater consideration. Our research on these family golf vacations also saw priorities placed on water-related activities (pools, beaches, water slides) and the convenience of onsite food and beverage choices.

The above illustration sheds insights on how generational and life-stage-specific values translate to new definitions of the golf vacation, and in turn inform areas of marketing emphasis by life-stage segment. A look at the hierarchy of importance derived from a study we conducted a few years back on the destination decision purchase journey defined these priorities differently across specific golf trip types.

For example, the business-specific golf trip placed weather conditions, course quality, overall accommodations and fine dining at the top of the list. This is somewhat intuitive given the tighter window for these experiences, coupled with a focus on white-glove treatment when entertaining customers. Juxtapose this against a buddy trip, which while sharing the narrow window driven urgency for pristine weather and course quality, deviates to prioritize tee time availability, coupled with value pricing and abundant nightlife. A look at couples’ golf trips adds the dynamic of available shopping among those more important desired aspects of the vacation experience.

A pervasive learning derived from our recent golf travel research, is that, like so many other high-involvement purchase decisions, a focus on customer segmentation and each segment’s broader wants are tantamount to effectively marketing a destination. A focus on needs-based storytelling can cut through the sameness of so much of today’s golf destination marketing.