Prolonged pandemic has golfers pondering ‘what if’ scenarios for when restrictions lighten

Throughout the current pandemic, golf has enjoyed a unique place among leisure activities. The sport has met consumer desires for outdoor exercise and socialization, while checking the boxes for being perceived as a safe and controllable activity.

In contrast, Sports and Leisure Research Group’s ongoing Back to Normal Barometer continues to show decreased appetites across a number of travel sectors, as well as activities that include movie theaters and live sporting events. The inaccessibility or tepid demand for these activities has benefited golf as we continue to see new high-water marks for rounds played and equipment spending.

Another byproduct of the COVID-19 environment has been the redirection of discretionary spending. For example, there has been an increase in expenditures on home improvement as well as a surge in residential real estate, aided by a multitude of factors including historically low interest rates and increased relocation away from more densely populated regions.

Of course, a big question is what happens when “all clear” is sounded. Though that isn’t the perfect measure of actual anticipated behavior, it does yield insights on where demand is building and can inform various sectors as to their respective level of importance.

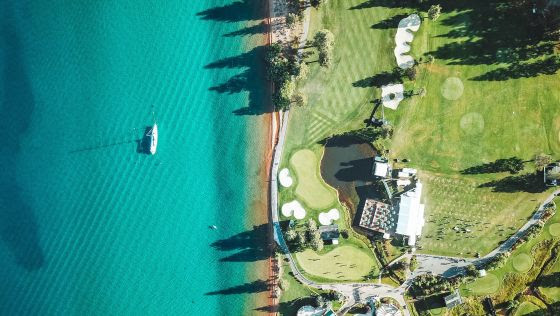

Sports and Leisure Research Group asked sports fans and golfers to reflect on a scenario in which the pandemic suddenly ended tomorrow, and indicate what one large discretionary purchase, if any, they would make. As the graphic reveals, taking a trip is the most prevalent response among both groups. Thus, it can be surmised that this pent-up demand for travel is a positive future indicator for the golf-resort sector, which has not reaped the economic benefits of increased play to the extent of other golf facilities. Equally encouraging is the observation that fewer than 25 percent of golfers plan to pocket any pandemic-driven savings.