SLRG’s initial look at end of year trends and what to expect in the golf industry in 2023

Our nationally acclaimed Back to Normal Barometer and recently released NGCOA Golf Business Pulse 2022 report continue to track facility operator and consumer attitudes and behaviors as the golf industry and leisure industry in general, navigate around a myriad of issues thwarting a return to pre-pandemic normalcy. As we speak with facility owners and operators, the big question continues to revolve around where things will flesh out as the pandemic driven golf boom meets an uncertain economy.

While the midterm elections are over, Americans are far from resolved on the year ahead. Only 40% of Democrats and 23% of Republicans that we polled in late November, believe that political tensions in the U.S. will ease in 2023. Independents are even less optimistic. If these sentiments bear out, it will be interesting to see their impact on potential challenging government regulations and their impact on facility operators. But legislative gridlock is what the preponderance of consumers are anticipating.

While the midterm elections are over, Americans are far from resolved on the year ahead. Only 40% of Democrats and 23% of Republicans that we polled in late November, believe that political tensions in the U.S. will ease in 2023. Independents are even less optimistic. If these sentiments bear out, it will be interesting to see their impact on potential challenging government regulations and their impact on facility operators. But legislative gridlock is what the preponderance of consumers are anticipating.

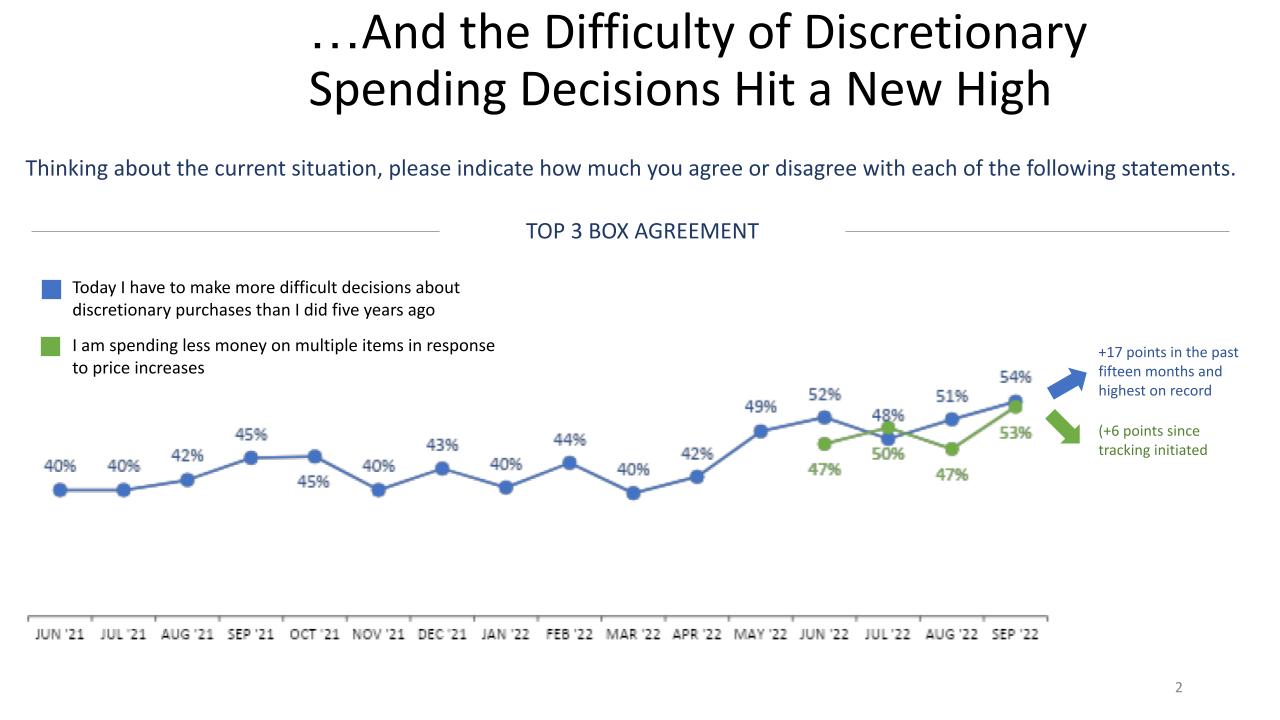

The economy continues to be the most concerning issue for Americans, with half strongly believing that we are currently in recession. Nearly 2/3 strongly agree that they are more budget conscious today than they were two years ago. Both of these measures are up +10 points since April. In two separate questions, only around a third feel strongly that they or the country are better off now than four years ago. This begs the question of whether we are approaching a tipping point given the pervasive increases in green fees that we observed over the past eighteen months.

recession. Nearly 2/3 strongly agree that they are more budget conscious today than they were two years ago. Both of these measures are up +10 points since April. In two separate questions, only around a third feel strongly that they or the country are better off now than four years ago. This begs the question of whether we are approaching a tipping point given the pervasive increases in green fees that we observed over the past eighteen months.

Yet, flying in the face of the economic headwinds is an increased emphasis being placed on work life balance in general and a focus on health and leisure time. The Barometer has shown how overwhelmingly, consumers believe that the COVID pandemic has transformed the ways in which we live in America, and activities like golf, continue to check the right boxes for those specific impacts.

Yet, flying in the face of the economic headwinds is an increased emphasis being placed on work life balance in general and a focus on health and leisure time. The Barometer has shown how overwhelmingly, consumers believe that the COVID pandemic has transformed the ways in which we live in America, and activities like golf, continue to check the right boxes for those specific impacts.

The golf industry is also likely continuing to benefit from a strong sentiment that other leisure activities that were limited during the pandemic have failed to deliver on expectations and prior recollection. This perception initially emerged in May and has yet to abate. In complementary work that we have conducted for the U.S. Chamber of Commerce and other clients, stresses brought about by the current labor imbalance have had particularly negative impacts on the ability of leisure sectors to deliver on expected customer experience. Golf’s historical strength in service and customer focus continue to provide us with a source of competitive advantage. Golf facility operators in the NGCOA Business Pulse study overwhelmingly agree, and we see 2023 being a year where facilities will need to maintain strong levels of high touch customer service, while balancing this alongside an influx of automation and self service options that create operational efficiencies. The challenge is exacerbated as we compete against other leisure and service verticals for quality staff, in a business climate that continued to see wage inflation and more empowered employees throughout the second half of 2022. It will be particularly interesting to see if recessionary forces tilt the scales back somewhat next year. That is thus far yet to be evidenced.

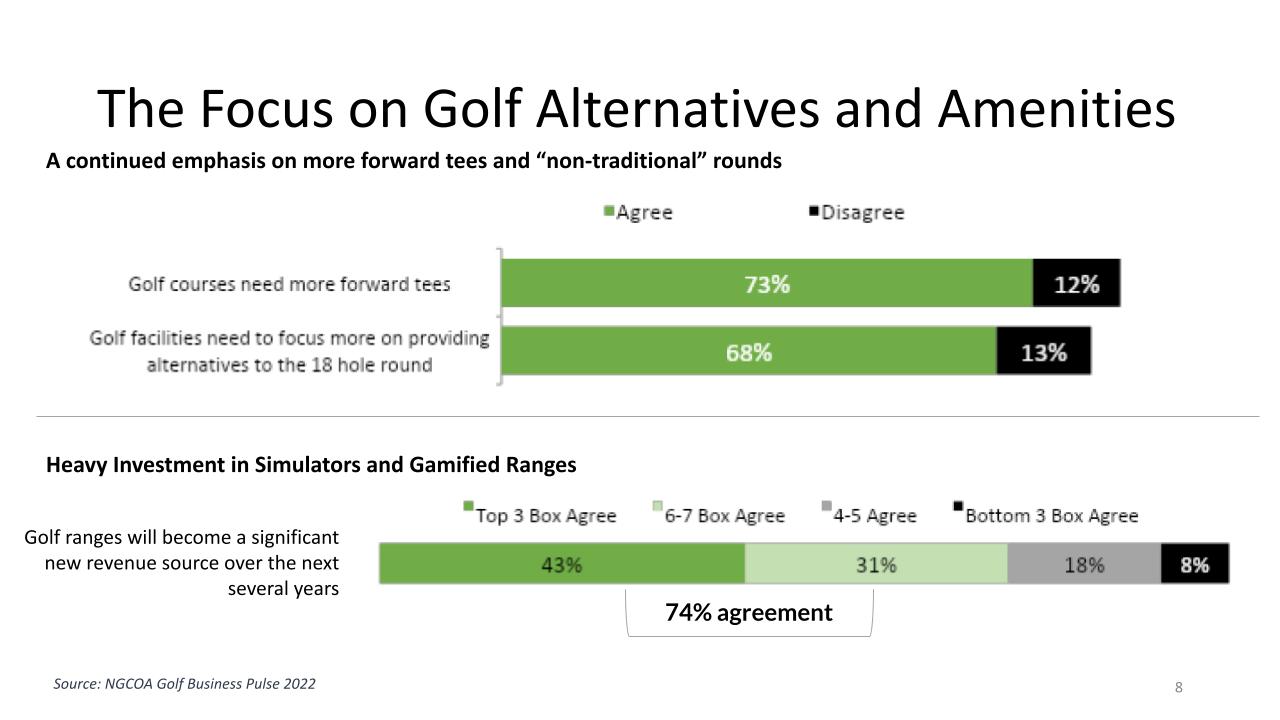

The trend towards greater customer centricity also applies to a continued push by many facility operators to evolve the golf experience to meet the influx of new and less avid players. The Business Pulse study showed the magnitude of operators embracing this through the addition of more forward tees, alternatives to the 18 hole round and an emphasis on simulators and other gamification elements to drive greater revenue from ranges and practice areas.

How compelling an offering facility operators can provide to this new influx of players, without disillusioning core customers will greatly determine whether 2023 will continue along the upswing that we’ve enjoyed over the past few seasons. In the Business Pulse study, there was alignment in the recognition that the industry needs to do a better job of cultivating these new players beyond their initial onboarding. 87% of owners agree that “Golf needs to do a better job of managing the customer journey of golfers once they complete their initial introduction to the game.” We would like to see this manifest itself in a better understanding of golfer needs as they navigate the transition from beginner to regular participant, and this will start with a better examination of how the golfer lifecycle intertwines with some of the macro redefinition of work-life balance, discussed above.