As we move toward a new normal, can golf sustain the surge in participation that came from COVID 19? Using the Back to Normal Barometer and other recent research, the cover story from SLRG’s Jon Last explores the attitudes and behaviors of golfers and how to leverage current competitive advantage in a post pandemic market

March 13, 2020 – On what otherwise would be described as a nondescript Friday morning, I boarded a flight from Las Vegas’ McCarran Airport back to New York. I had traveled to Sin City with two primary purposes. Firstly, we were conducting one-on-one golfer interviews for an OEM client, to evaluate consumer reaction to a variety of new retail concepts. Alongside that project was attendance at the Men’s PAC 12 Conference Basketball Tournament, an event for which our team has been consistently researching fan sentiment and the efficacy of in game sponsor activation for many years.

The latter began as it always had, with a few bubble teams competing in front of a good-sized crowd, in the hopes of pulling off an upset. But from the onset, there was an ominous buzz and dark pall brewing around the event. Intense and amplified media coverage about COVID-19 had become pervasive and troublesome. NBA player, Rudy Gobert, had tested positive for what was then trumpeted as a mysterious but deadly virus.

Midway through the Wednesday evening session, word came out that spectators would be banned from attending the tournament the following day. In a span of less than 24 hours, the sports, travel and entertainment world ground to an abrupt halt. Immediately, the NHL turned off the lights in their arenas coast-to-coast, the Blue Jays Spring Training games stopped, the 2020 Memorial Cup to be held in Kelowna was cancelled, and hotel rooms became vacant everywhere.

The continent locked down, and as I sat alone in my row on a flight with about ten people on this Friday the 13th unlike any other, I contemplated the short-term and long-term implications for our industry and all of leisure. As a marketing researcher, I knew that we needed to get a handle on separating reality from conjecture. The next several days was a frenzy. We reached out to clients and partners. I reflected back on an attitudinal consumer pulsing study that my team and I had created at Golf Digest, after the horrific events of 9/11, and the early foundations of our Back to Normal Barometer were born.

Since early April 2020, we have been continuously pulsing the attitudes and behaviours of golfers, travelers and participants in a litany of leisure activities through the Barometer. Our work has garnered major international media coverage that earned our public relations partner a prestigious Gold Medal for Best Use of Custom Market Research. The Barometer has regularly informed the likes of some 14 of the leading U.S. trade associations outside of golf, including U.S. Travel, The American Resort Development Association, The National Association of Realtors, American Gaming Association, multiple airline and aviation authorities as well as the U.S. Chamber of Commerce and administrative and governing bodies in golf and other sports. It has been an intense but insightful ride that still endures.

Concurrent with our Barometer work, custom golf industry work has not abated as the COVID induced participation surge has literally spawned thousands of in person, virtual and observational golfer interviews. There’s a lot to process, and a lot for the industry to learn.

GOLF AND THE POPULAR NARRATIVE

As we’ve moved through various phases of the COVID-19 pandemic, the golf industry has emerged as one of its few consistent “winners.” Research from our firm and others has chronicled a surge in participation and golf related spending that has long been elusive. Even the mainstream media, which just five years ago, piled on golf, claiming that it was antiquated and declining, has marveled at how the constraints of the pandemic created a perfect storm that has driven a renaissance for our sport.

I’ve previously written and reported on how those mainstream doom and gloom prognostications were misguided and based on opportunistically selected data interpretation, so I won’t dwell on its flaws here. In place of this muckraking has been a rosier portrait of a leisure activity that filled the pandemic driven voids for social interaction, escape from the confines of quarantines and an opportunity to get outside and commune with friends and nature in a safe and socially distant manner. Couple that perspective with welcomed stories of a more inclusive and social game, and all of a sudden, golf has become cool and contemporary in these pandemic driven times.

BEYOND THE NARRATIVE: REALITIES OF THE PARTICIPATION SURGE

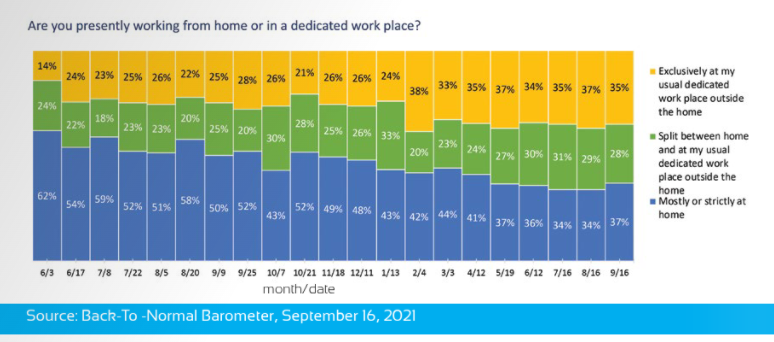

Of course, the truth below the narrative is slightly tempered. Our data has consistently shown that the preponderance of rounds played and dollars spent, continue to come from the previously defined core and avid players that still represent some 80% of spending and participation. As with others, the pandemic has provided greater time flexibility, with nearly a third of golfers still not back to full time work in a dedicated out of home workplace, as we entered the Fall. This extension of pandemic induced restrictions, the onset of the Delta variant and an attitudinal trepidation that continues to pervade the consumer mindset, enabled 2020’s participation surge to extend deeply into the 2021 golf season.

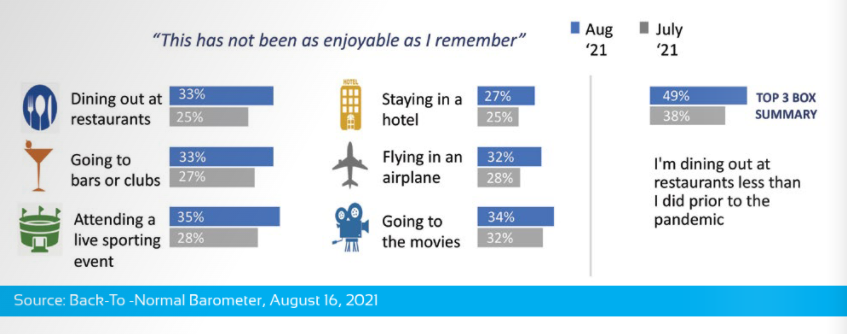

Another driver that has extended the halo of the COVID golf surge has been a failure of competitive recreational activities to adequately seize upon the latent demand that built for them during the shutdowns and attendance restrictions. While the Barometer found early and often, a building desire and willingness among a majority of consumers to return to favourite past times like travel and sporting events, movies and indoor dining, the lifting of attendance restrictions (and in many cases, subsequent reinstitution of them) has for a majority of consumers, been quite underwhelming. This sentiment has continued to build, particularly among newer and less committed golfers.

Spawned on by labour shortages, an inability of much of the service sector to deliver the levels of customer facing attention that people expect, and the COVID safety net that golf became for many who were not previously committed to it, golf has a better opportunity to secure its space as an ongoing staple of discretionary time and spending. Case in point, in late August, over a third of all surveyed agreed that dining out at restaurants, going to bars or clubs, attending a live sporting event and going to the movies, were each “not as enjoyable as I remember.”

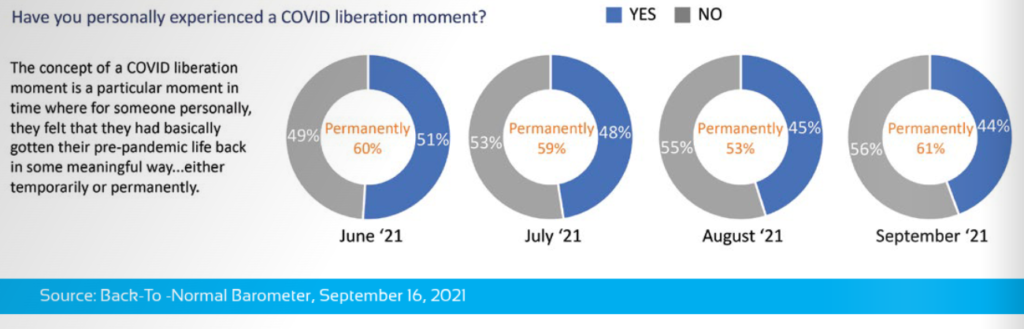

Another intriguing measure in the Barometer has shown less than half expressing that they have had a “COVID Liberation Moment” – defined in the research as a particular moment in time when someone felt that they had basically gotten their pre-pandemic life back in some meaningful way…either temporarily or permanently. In late September, only 44% of golfers had experienced this COVID liberation moment. The overall incidence for experiencing these moments of liberation, has dropped for three consecutive months. In late September, only 29% of all Barometer respondents strongly agreed that “from my standpoint, the COVID-19 pandemic is over.” Yet 75% of those who have played golf during the pandemic agree with the statement that, “Golf today can be an oasis from the stresses of life.” We’ve been tracking that sentiment for two decades, and we remain at or near a high point.

Within the Barometer, we have also been tracking general sentiment about when we will be back to pre-pandemic “normalcy.” The trend has suggested that this may be elusive, as the time horizon continues to move outward. In late September, we again asked all respondents to use a 10-point scale to indicate “from the standpoint of COVID related restrictions, safety protocols, business closures or capacity restrictions, [we] will be up and running as it was pre-pandemic,” where 10 indicates pre-pandemic conditions and 1 indicates total lockdowns. Those providing an 8-10 score for the end of 2021 is just 27%…down from 63% who felt this way back in October of 2020. In fact, less than half expect conditions to be an 8-10 by the end of the second quarter of 2022….that’s into the heart of next year’s golf season. So bundle these lingering concerns, and a less than stellar re-opening of activities competitive to golf, and a large opportunity remains for our industry to continue to ride a wave of strong demand.

BEWARE THE STRESS ON LABOUR

Above, I referenced that our research has shown a marked decline in service levels experienced by consumers returning to non-golf leisure activities. The fact that golf has been able to rise above that is a testament to how we’ve managed through the pandemic.

In conversations with various industry executives, the fact that shutdowns were only imposed on golf for a relatively short period of time, compared to these other activities, has been a big source of competitive advantage. Unlike the travel industry, which experienced mass layoffs, golf industry employment has remained relatively constant. But, the elephant in the room remains macro-economic headwinds with microeconomic implications. The Barometer has shown trending of significant inflationary pressures. Those indicating that compared to six months prior, the prices paid for items and services they continually buy is much higher now, has risen fifteen points from 17% in May to 32% in late September. Seventy percent say that prices are somewhat or much higher now than they were in March of 2021.

Exacerbating the inflationary concerns is a rampant labour shortage that doesn’t appear to be subsiding. This summer, before the emergence of the Delta variant, we conducted a custom study among those unemployed and displaced during the pandemic, many of whom were being subsidized by government stipends (such as CERB). The results of the research affirmed that over a third of these “COVID unemployed” were willing to remain on the sidelines. Further, our findings informed and foreshadowed what many are labeling as “the great resignation,” where the pandemic and a greater focus on alignment of one’s personal values and those of hiring organizations continues to fuel a significant worker shortage, high turnover and increased wage pressures.

In ongoing interviews and discussions with golf course superintendents, architects and facility operators, the issue of finding and retaining quality labour at competitive rates remains a primary concern, particularly on the course maintenance side. Our research has consistently shown the quality of the green complex and overall course conditions to be at the top of the list of golfer satisfaction drivers. If perceived quality falters, and if golf facilities cannot profitably maintain relatively better service and overall customer experience than presently struggling competitive leisure activities, we risk regressing back to pre-pandemic levels.

THE CHALLENGE OF “GOLDILOCKS”

So, the ultimate questions for golf facility operators and the industry as a whole surround not only the duration of the surge, but what proactive measures should be taken to continue to exploit and prolong it. Therein lies the Goldilocks metaphor, that is so germane to finding the right answers. What is too hot? What is too cold? And what is “just right” in terms of your consumer facing strategy and marketing messaging?

As the Barometer and other custom research that we have conducted over the last twenty months have shown, we are living in an incredibly divisive time. Our Barometer subscribers have marveled, along with us, at the “Two divisions of North America” that have emerged and the deepening of the gulf between them, over the course of the pandemic. While golf may be largely removed from the chasm of partisan legislative politics, there is also a variety of experiential needs and desires that golf facility operators, OEMs and others servicing the game must be quite mindful of.

As I alluded to earlier, one of the byproducts of the pandemic golf surge and the dedicated efforts of many in the game, is that we have made great strides and put strong industry focus on making golf more egalitarian. In late September, nearly two thirds of golfers agreed with the statement, “There are more new golfers playing the game now than there were at this time, last year.” We’ve seen the proliferation of alternate golf facilities. Nine hole rounds continue to be popular and we can directly attest from some of our recent work, to the benefits of steering golfers towards proper tee box selection based on one’s abilities and desired experience.

We’ve also done some formal and informal attitudinal golfer segmentation over the past year plus. The slight tinges of grey in what remains of my hair are perhaps reflective of the fact that I did my first golfer segmentation work of this type, while a PGA of America staffer, nearly three decades ago. Looking back at the evolution of who the golfer is and has become, provides compelling evidence that we have made strong progress towards the objective of evolving the golf experience and availing it to a wider audience. Our work is far from done here, if it is our objective to significantly grow participation. But the modicum of success that we have had, amplified by the pandemic, further illustrates that we have a starker strategic decision to make, if we conclude that we can’t be all things to all people.

And therein lies, what we believe will be one of the greatest post pandemic challenges for golf operations and marketing. Who do we want to be both collectively and in our business operations, amidst a society and leisure industry that continues to move the goal posts on recognizing and catering to the desires of “the individual” rather than a collective mass? The real underlying answer may not be as straightforward as one may wish to believe.

The ability for us as researchers to qualitatively probe and utilize projective techniques to get at the essence of consumer motivations has yielded dichotomous and sometimes personally alarming perspectives on what one desires from their golf experience, in ways that many likely wouldn’t feel comfortable articulating in public. To again reference the Goldilocks metaphor, what is too hot for one, may be too cold for another. For those lauding the proliferation of “kinder and gentler” golf experiences, there are others deeply concerned about how the industry needs to simultaneously maintain the essence and values that were the foundations of golf. The concept of “golf as an oasis” is often cemented in a nostalgic and change resistant recollection of a bygone and better day.

So, can we have our cake and eat it too? Again that strikes me as one of the most important questions that any golf business needs to confront. To answer it appropriately requires long hard thought, and ideally the elements of formal strategic planning. It entails getting a strong and accurate, research driven perspective of who your current customers are. How satisfied are they and what do they desire and need from you? It requires understanding how that customer composition may or may not vary from those of your competitive set…not just within the golf space but defined more broadly in how people choose to spend their leisure time and discretionary income. It requires understanding the foundational elements of your existing brand and product offering and how those can be differentiated from the competition in ways that meet desired needs. Only after procuring these insights can you determine what you want to be, what you want to offer and who your likely targets are.

The pandemic will end. Some form of a new normalcy will continue to emerge, and the broader competitive set of leisure activities will also continue to evolve and morph in ways that will ultimately test the resolve of the roughly 5 million more casually engaged and less committed Canadian golfers.

Only 30 months ago, the golf industry was consolidating. Market share battles were intensifying and our research demonstrated that there may not have been enough pieces of pie to slice up for everyone. Seminal events like pandemics may make it easy to forget those times. When things are good, it can be easy to eschew the need to avoid complacency. But, as one who has studied the foundations of consumer loyalty throughout my career, these are the best times to take a deeper and more reflective look…and to make sure that the porridge (or is it poutine?) is just right.