SLRG’s Golf Market TrendWatch Study, conducted with the ASGCA, shines a light on some intriguing shifts in golf facility trends.

At the start of 2021, we released the latest Golf Facility Market Trend Watch report, the fourth iteration of the annual study we produce alongside the American Society of Golf Course Architects (ASGCA). The report is designed to help understand what people within the golf industry consider to be the most significant challenges, opportunities and issues in golf facility design and operations.

The report is based on a survey of golf course architects, superintendents, general managers, facility owners/operators, golf professionals and industry leaders.

One aspect of the 2021 report that makes it stand out from previous years is that the data was collected amid the backdrop of the COVID-19 pandemic. With this in mind, we added some new questions to gauge what people working in the golf industry were feeling in terms of the pandemic’s impact.

We have all seen and heard about the increased numbers of golfers taking to the course during the pandemic. In the summer issue of By Design, I read about entire tee sheets being booked up in seconds. These observations are reflected in our findings, with 85 percent of superintendents identifying a surge in play as one of the most notable aspects of 2020, a great contrast with the experiences of many other industries. Sixty-six percent also highlighted a meaningful increase in the number of new players at their facility, with a similar proportion reporting that the COVID-19 pandemic has had a positive effect on operations.

Around half of owners/operators have said that this increased play has created additional stress on their course maintenance programs during 2020. From their perspective, this has had little impact on timescales for capital projects, but 56 percent of golf course architects say they have seen delays in decision-making on projects to improve the golf course.

Despite this, the volume of renovation business over the past 24 months shows nearly half of golf course architects reporting a year on-year improvement, up from 36 percent reporting an increase last year. Course renovations continue to generate the strongest interest among potential facility enhancements, with the next most desirable areas being expanded junior golf programs and an enhanced food and beverage experience.

This desire for renovation work has been stable at private clubs, but it is notable that it is increasing among public facilities, from 39 percent in 2019 to 46 percent in 2021.

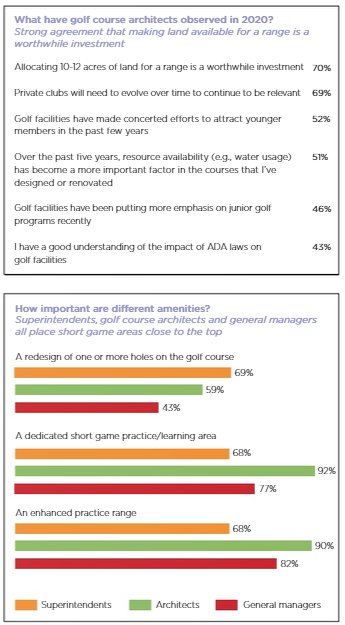

Golf course architects and superintendents are aligned on prioritizing ranges, with 70 percent of golf course architects and 64 percent of superintendents including ‘allocating 10-12 acres of land for a range is a worthwhile investment’ among the top three statements they agree most strongly with, from an extensive list.

Practice area improvements have become the most prevalent type of project for golf course architects and 92 percent consider a dedicated short game area to be a top five amenity for today’s golfers.

As well as a 13 percent spike in practice area projects, there have also been increases in bunker projects, greens renovations, tee redesigns and projects to add more forward tees.