Better equipment leads to better results, right? That’s the thinking of many golfers surveyed as to why they are willing to pay more for equipment

For more than 10 years, Sports and Leisure Golf Research has pulsed preseason golfer demand for new equipment, and the findings have certainly foreshadowed the higher-price achievement that Original Equipment Manufacturers have enjoyed on a per capita basis.

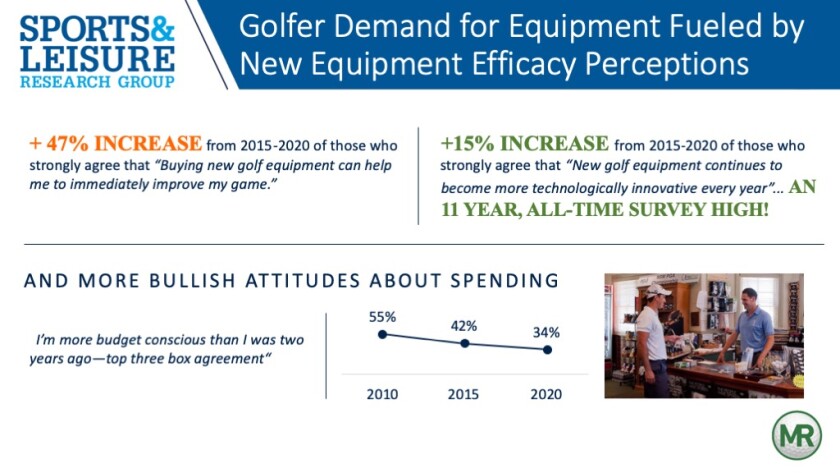

So, why are golfers looking to pay more for their equipment? Our research continues to show that consumers are buying into the expectation that new equipment will lead to immediate game improvement. The percentage of those who subscribe to this thinking has increased nearly 47 percent over the past five years. This efficacy expectation has been driven by a mix of great product, great marketing and overall consumer confidence and resiliency among golfers — even amid the COVID-19 pandemic.

We also see a 15 percent five-year increase in those golfers who strongly concur that equipment is becoming more innovative every year. This represents an all-time high since Sports and Leisure Golf Research first measured this in its annual golfer omnibus survey.

The rise in premium custom-fitting studios is also helping to drive this phenomenon. The final driver is seen in the accompanying graphic, where we’ve witnessed a consistent drop among those golfers who consider themselves to be more budget conscious than they were two years ago. Just over one-third are today, compared to more than half at the start of 2010.

In qualitative research, we’ve gained additional insights as to why a premium is being placed on new equipment. The dramatic increase in distance observed at the highest levels of the game has had a meaningful effect on the average golfer’s psyche and aspirations. Couple this with the foundational buy-in to technological innovation — along with the COVID-fueled participation surge — and it’s no surprise that we have seen recent reports in backordered hard goods and new high-water marks in monthly equipment sales.