Golf Industry analyst Casey Alexander’s annual golf industry outlook includes some encouraging new golf consumer data culled from SLRG’s annual Outlook Report.

December US Rounds Played Lead to Record Rounds Played Year; Key Takeaways from the PGA Merchandise Show

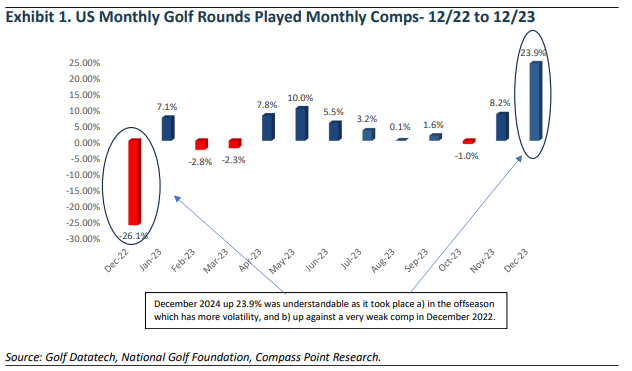

December 2023 US Golf Rounds Played Up 23.9%. Against a very soft 2022 comparison, December 2023 U.S. golf rounds increased 23.9% year over year (rounds played were down (26.1%) in December 2022), according to the monthly report from Golf Datatech . This follows the November 2023 reading, which was up 8.2%, and the October 2023 reading which was down (1.0%). We are now in the offseason when monthly changes have a broader impact on YTD readings. We also note that December weather as measured by Golf Playable Hours was highly beneficial, coming in up 41%. 2023 YTD rounds finished the year up an impressive 4.2% versus 2022. U.S. Golf rounds played finished in 2023 with a record year with over 520M rounds played.

Regional results for December were understandably strong with all eight regions reporting rounds played gains. The strongest regional contribution came from the East North Central region (OH,

MI, WI, IL, and IN) which was up 153.4% for December. The South Atlantic region (NC, SC, FL, GA, VA, WV, MD, and DE) had the slowest rate of growth at 11.9%.

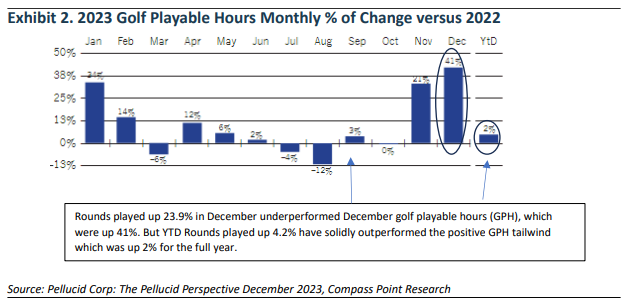

Weather Was a Positive Contributor for the Year. With no major weather events in December, we saw a 41% YoY increase in GPH when compared to December 2022. So rounds played underperformed the positive weather comp in December. But when we look at the YTD numbers, US Golf rounds played are up 4.2% YTD versus GPH which has improved 2% in 2023. And those may recall that 2022 was one of the worst weather years ever for the golf industry.

Key Takeaways From the PGA Merchandise Show

Last week we attended the 71st Annual PGA Merchandise Show. We sampled equipment at the PGA Show Demo Day. We met with senior executives of multiple equipment providers and apparel

& accessories companies. We met with golf industry researchers and discussed products with customers. With all of that input, we came away with one important conclusion; 2024 is highly likely to be a record year for U.S. golf equipment sales, especially hard goods sales. We remind clients that the U.S. is responsible for ~50% of the market for golf equipment. In general, as the U.S. goes, so goes the Rest of the World.

Our reasoning follows a logical set of facts and follows with a logical conclusion, but one that might not be apparent to every analyst covering the golf equipment space.

Defining Fact Number 1. As we mentioned previously in this report, 2023 will finish the year with a record number of U.S. golf rounds played, over 520M rounds. Participation doesn’t necessarily guarantee strong equipment sales, but just knowing that the level of participation is at all-time highs sets a constructive base for 2024 sales. The weakest element of this argument is that if rounds played are down in 2024 relative to 2023, that could impact the sales of golf consumables such as golf balls, golf gloves, shoes, and golf bags.

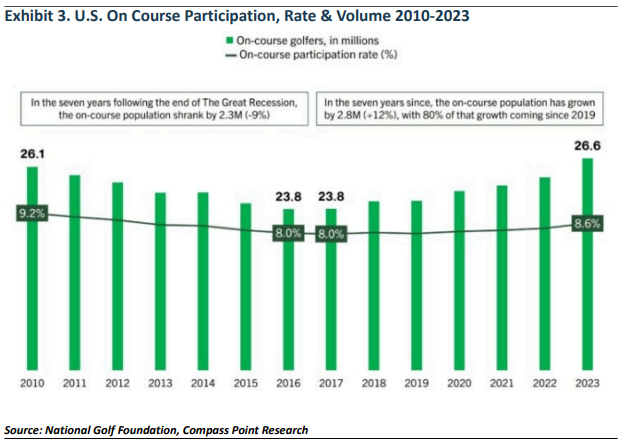

Defining Fact Number 2. A record number of people are playing golf in the U.S.

Exhibit 3 tells us that 26.6M people played on-course golf in 2023. While this is an all-time record, it is not a record as a percentage of the U.S. population. In 2010, 9.2% of the U.S. population played on-course golf. That percentage dropped to 8% by 2016 before rising to 8.6% in 2023.

But we have now established that a record number of people played a record number of golf rounds in 2023. That seems like two very healthy data points.

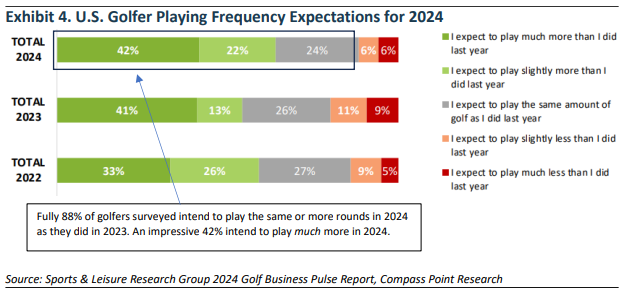

Defining Fact Number 3. The most logical question following our first two facts is how do those facts relate to 2024 behavior? For that, we turn to the Sports & Leisure Research Group which surveyed thousands of actual golfers and learned that 88% of them intend to play as much or more golf in 2024 than they did in 2023 . This is the highest reading in years.

What is equally revealing is that of the 88%, 42% intend to play much more with another 22% that intend to play more than they did in 2023. So 64% of golfers surveyed intend to play more golf in 2024 than in 2023. We recognize that the intention to play does not always follow with the ability to play. Adverse weather, economic factors such as affordability, and job changes can all impact

the actual ability to play.

We note that weather, as measured by Golf Playable Hours, gave U.S. golfers a 2% assist in 2024, but the total number of Golf Playable Hours was still below the 10-year historical average. At the presentation of the Pellucid/Edgehill 21st Annual State of the Industry, the weather forecast is for another 2% YoY improvement in Golf Playable Hours in 2024. Weather has returned as the most important leading indicator for rounds played (as opposed to COVID-related factors).

So now we have three facts: 1) a record number of people, 2) played a record number of golf rounds in 2023, and 3) intend to play more rounds in 2024.

In our view, the logic follows that golfer intentions are far more important to gauging spending on equipment than their actual ability to play. Golfers spend to meet their intention; how much they actually will be able to play is unknown when the majority of spending decisions are made.

Defining Fact Number 4. So what did actual golfers surveyed say about their equipment intentions? As we can see in Exhibit 5, 96% of golfers surveyed intend to spend as much or more on golf equipment in 2024 as they did in 2023, with 52% intending to spend more. According to Jon Last of the Sports & Leisure Group, the playing intentions and spending intentions are some of the strongest readings ever recorded.

So now we have four facts: 1) a record number of people, 2) played a record number of golf rounds in 2023, 3) intend to play more rounds in 2024, and 4) intend to spend more on equipment in 2024.

It simply follows that a record number of players playing a record number of rounds who intend to play and spend more in 2024 is likely to lead to record equipment sales in 2024. And that is the basis for our forecast. The golf equipment companies should have a strong tailwind for 2024.

What Does This Mean for Our Coverage Companies? We should be able to expect stronger growth in Net revenues for both Acushnet ( GOLF — Buy, $71.oo PT) and TopGolf Callaway ( MODG — Buy, $21.00 PT). Also, record sales should imply strong margins for the business. And yet both our models and the Street consensus have very modest expectations.

For GOLF, we forecast 1% Net Revenue growth YoY in 2024 (See our report Raise Price Target to $71; Golf Ball Rule Change Appears Manageable & Capital Returns Likely to Continue; Reiterate Buy Rating ). And we also expect that when GOLF reports 4Q23 results, they will give exceedingly conservative guidance. What this tells us is that 2024 is set up for another year where GOLF can outperform guidance and expectations, and generate strong financial returns.

For MODG, the calculus is somewhat different in that MODG did not meet initial guidance in 2023 for the first time in 10 years. We forecast 2% Net Revenue growth YoY in 2024 for the golf equipment and Lifestyle divisions, but we see the majority of that growth coming from increasing the brick & mortar store count at TravisMatthew. (See our report Revaluing MODG & Looking at Individual Units for SOTP; Reduce Price Target to $21 & Reiterate Buy Rating ). Given the way 2023 progressed, we would expect guidance so conservative that beating it will be an almost foregone conclusion.

Summary. The bottom line is that we have accumulated a preponderance of evidence that suggests golf equipment sales in the U.S. could set new records in 2024. This healthy backdrop should be supportive of share prices for both GOLF and MODG, although GOLF is the more pureplay, given the MODG exposure to TopGolf.